owners draw report in quickbooks online

Choose Lists Chart of Accounts or press CTRL A on your keyboard. Select the Bank Account Cash Account or Credit Card you used to make the purchase.

Quickbooks Owner Draws Contributions Youtube

In QuickBooks Onlines owners draw account company assets are used to pay an owner by tracking withdrawals.

. Corporations should be using a liability account and not equity. Owner S Draw Quickbooks Tutorial How To Read Your Quickbooks Online Profit Loss Report Deximal How To Setup And Use Owners Equity In Quickbooks Pro Youtube How To Pay Invoices Using Owner S Draw Quickbooks Online Tutorial Part 18 Viewing And Creating Reports Youtube Owners Draw Balances. QuickBooks Online uses owners draw accounts in order to pay its owners for withdrawals of assets made from its account.

To create an Equity account. If youre the business owner and want to record an owners draw youll basically want to write the check out to yourself like you are paying yourself with a check. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask.

Select New in the Chart of Accounts window. You will pay the owner using an owners draw account. Also what is owners draw vs owners equity in QuickBooks.

How do I show owner pay in QuickBooks. If you are a quickbooks User Sometimes you may need to record owner investment in quickbooks Which will help the business to hire the right amount of people Business Equipment Development and research. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

From the PAY TO THE ORDER OF field select the vendors name. Recording draws in Quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to. Pick the transaction click on the Categorise option pick out Expense because the transaction type myself because the SupplierCustomer and Owners Equity.

How do i run that report. Go to Banking Write Checks. Enter the account name and description Owners Draw is recommended When you are done hit on Save Close button.

Enter owners contribution in the name field. In order to create a profit and loss report in quickbooks Online You will need to first navigate to the Reports tab and then select Accountant Taxes. Enter the Amount.

To Write A Check From An Owners Draw Account the steps are as follows. QuickBooks Online In years past the business had a contractor who the owner married and for tax year 2021 they are business partners. Click on the Banking menu option.

So your chart of accounts could look like this. How do I show owners draw in Quickbooks. A journal entry closing the drawing account of a sole proprietorship includes a debit to the owners capital account and a credit to the drawing account.

When you put money in the business you also use an equity account. Expenses VendorsSuppliers Choose New. Select Equity from the Account Type drop-down.

Set up and pay a draw for the owner. Select the Gear icon at the top and then select Chart of Accounts. The Owner or its partner invests their personal money to a business that investment is known as Owner Investment.

At the bottom left choose Account New. Choose Lists Chart of Accounts or press CTRL A on your keyboard. Search for the owners pay.

2 Create an equity account and categorize as Owners Draw. Enter an opening balance. Click Equity Continue.

Select Owners Equity from the Detail Type drop-down. For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership. Search for the owners pay account in accounting then.

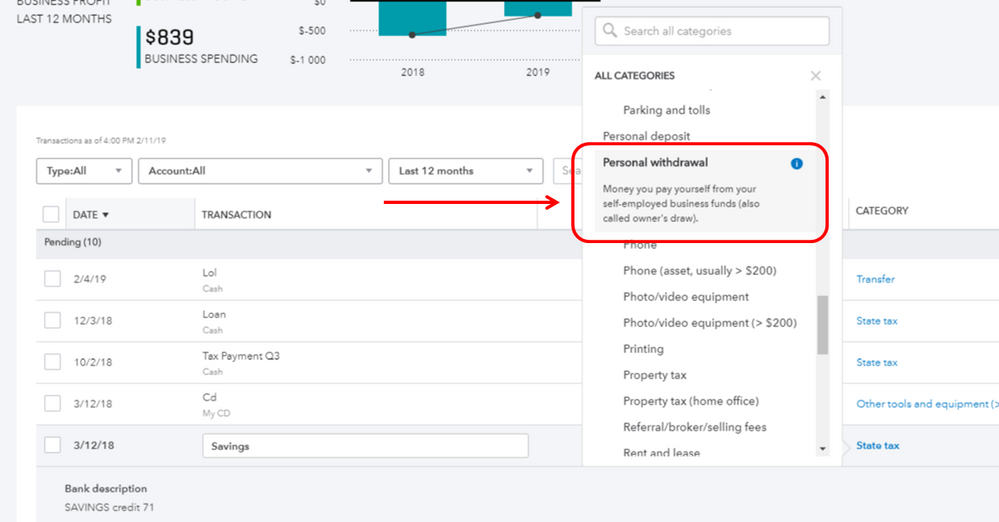

Owners Draw because the category with GST set as Out of Scope 0. When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on the owners equity in the business. If youre a sole proprietor you must be paid with an owners draw instead of employee paycheck.

Open the chart of accounts use run report on that account from the drop down arrow far right of the account name. Enter and save the information. In fact the best recommended practice is to create an owners draw.

Click the Expenses tab and then select the account category that best fits your needs. To record a transaction between the business and owners account go into the Banking menu in Quickbooks and select the option titled Write Checks. I just want a report on owners draw.

Write Checks from the Owners Draw Account. Quickbooks allows you to. Select Chart of Account under.

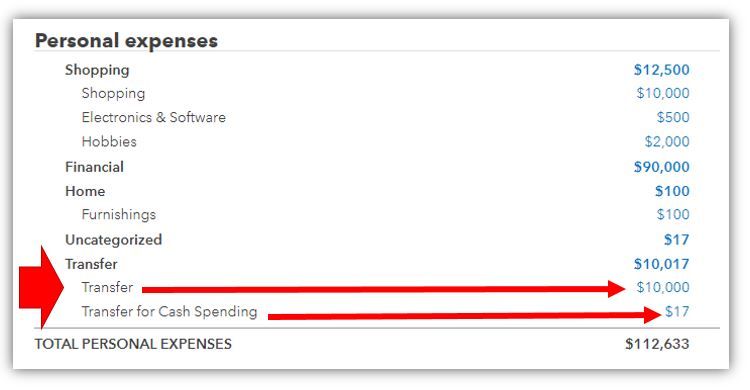

An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner. You will then be able to select the year for which you would like to create the report. How do you record ownership of a distribution.

Next click on Profit Loss under the Tax section. An owners draw account is a type of equity account in which quickbooks desktop tracks withdrawals of assets from the company to pay an owner. 1 Create each owner or partner as a VendorSupplier.

Click Save Close. It is important to note that sole proprietors are paid with an owners draw instead of employee paychecks. Would you simply categorize payments to this person as Owners Draw.

Click Equity Continue. Then choose the option Write Checks. Owner draw is an equity.

Enter the account name Owners Draw is recommended and description. At the bottom left choose Account New. Due tofrom owner long term liability correctly.

Select the Gear icon at the top then Chart of Accounts. Owner draw is an equity type account used when you take f Owner draw is an equity type account used when you take funds from the business. Only a sole proprietorship a partnership a disregarded entity LLC and a partnership LLC can have owner draws.

To create an owners draw account. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. When youre self-employed your wages will be paid instead by an owners draw.

Select Save and Close. Or pick the transaction click on the Record as switch option and set the Transfer account to Owners Equity. In QuickBooks Desktop software.

Click Save Close. Heres how to do it. Enter the account name Owners Draw is recommended and description.

How do I report an owners draw in QuickBooks. Make sure you use owners contributionsdraws equity vs. For example at the end of an accounting year Eve Smiths drawing account has accumulated a debit balance of 24000.

Solved Owner S Draw On Self Employed Qb

How To Pay Invoices Using Owner S Draw

Owner S Draw Quickbooks Tutorial

Quickbooks Help How To Create A Check Register Report In Quickbooks Inside Quick Book Reports Templates Great Cre Quickbooks Help Quickbooks Check Register

How To Pay Invoices Using Owner S Draw

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting